UPDATE: Important Section 301 Tariff Information For Chinese Imports

07/30/2018

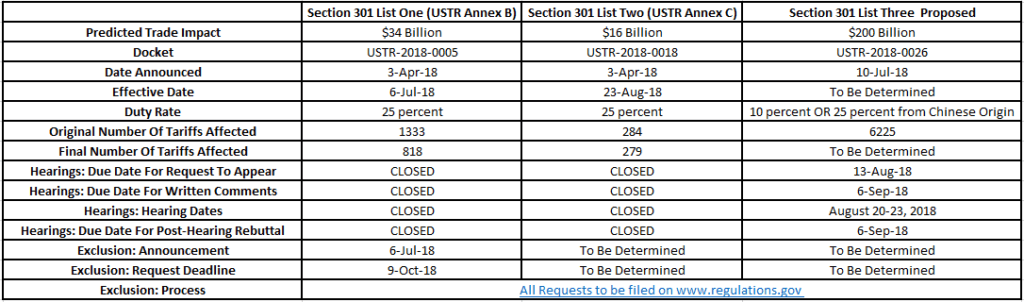

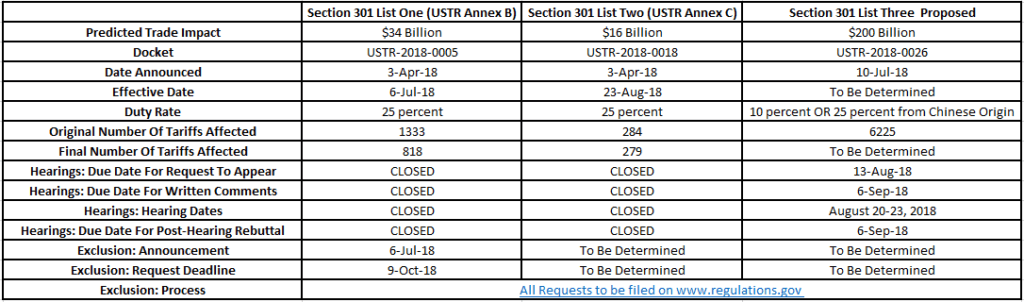

With all the recent updates to tariffs, Ascent Global Logistics hopes to provide key information that will allow you to maintain peak supply chain performance. Currently, there are three main lists of tariffs on U.S. imports from China that you should be familiar with:

- Section 301 List One (USTR Annex B): currently is in the exclusion process

- Section 301 List Two (USTR Annex C): currently in the public comment process

- Section 301 List Three (Proposed): currently in the public comment process

Please note that for the lists that are currently in the public comment process, importers can request that certain information remain confidential. This request must be submitted with additional indicators on the documentation or the submission will default as public. Public submissions are open to comments from firms who may affirm or dispute any presented details.

Should the USTR take action and implement the additional duties and tariffs on U.S. imports from China, it is anticipated that there would be an exclusion process similar to the one available for the tariffs that took effect on July 6, 2018 (Section 301 List One – USTR Annex B).

Current State Of These Three Section 301 Tariff Lists For Chinese Imports:

*This chart was updated on August 9, 2018.

The following URLs are links to the dockets listed above:

All requests for the Exclusion Process are to be filed. Please note that when filing a public comment, make sure that your comment is associated with the correct docket number.

How Can I Request More Information Regarding These Lists Of Tariffs For Chinese Imports?

To request more information regarding duty and tariffs on U.S. imports from China, please contact us or reach out to your Ascent Global Logistics representative directly. Our team will be able to assist you with staying up-to-date on all information related to tariffs and international trade.

You can also find important information on the U.S. Customs and Border Protection website.

December 9, 2024

Thank you for contacting Ascent!

A member of our team will be in contact within a few business hours.

Okay