International Freight Market Overview

04/30/2021

At a Glance:

- Consumers have purchased a record number of goods, especially in home and lifestyle categories.

- Quarantine has drastically limited spend on services, events and vacations.

- Government stimulus has provided U.S. citizens with additional funds to spend above earnings.

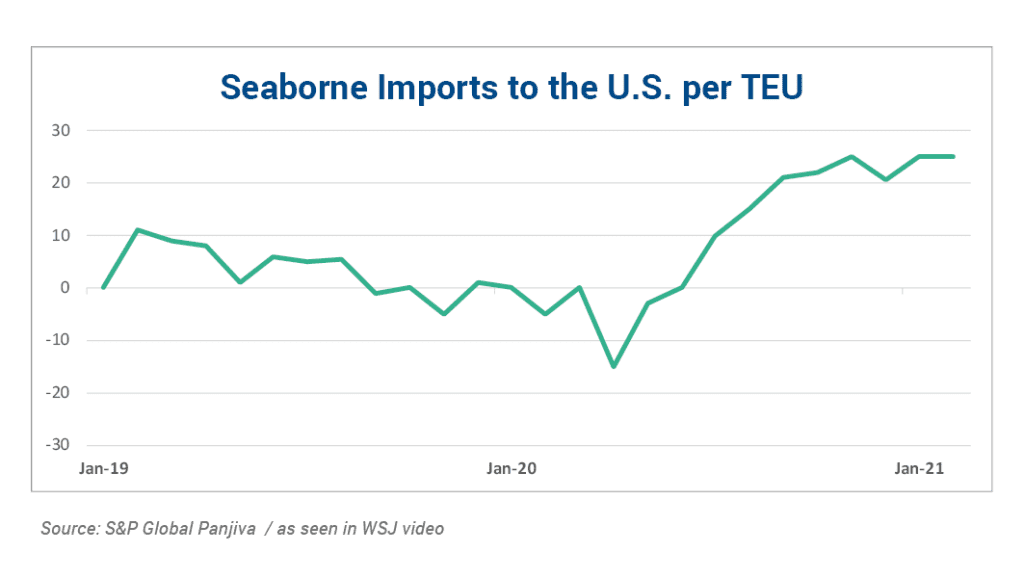

- Retailers and manufacturers have had to import an extra 25% more inventory to meet consumer demand.

- Ocean carriers respond by increasing vessel size and the number of containers loaded; also impacted by COVID-19 regulations for crew testing positive and contract tracing.

- Airfreight capacity continues to be limited to cargo airlines, as passenger commercial aircraft lanes have not rebounded due to the resurgence of COVID-19 and its variants.

- Ports are operating with reduced staffing due to illness and contact tracing regulations. The U.S. largest port in Los Angeles reports that as many as 1,800 skilled dockworkers were off the job in January 2021 due to positive tests and exposure adherence to guidelines.

- Ships are larger; there is more freight; there is limited equipment and skilled workers to handle loading and unloading; there is a shortage of containers to meet the demand for products sent from Asia to the United States.

Summary of International Freight as of April 2021

Ocean freight continues to experience unprecedented capacity and equipment shortages, driving up shipping costs and leading to lengthy delays in the supply chain. When importing to the U.S., prices, on average, have quadrupled compared to pre-pandemic shipping in early 2020. Because of the volatility in the ocean freight markets, high-value shippers with deep pockets have been driven to airfreight. Global air cargo volumes have rebounded to pre-pandemic capacity; however, commercial passenger aircraft contributing to overall cargo capacity remains constrained, with limited international flights.

How Did We Get to This Point?

Once it became evident in April 2020 that the world was headed for a long-term quarantine, U.S. consumers desired home office and exercise equipment well above the inventories available domestically.

Stimulus checks and housing markets also called for tremendous volumes of products and home improvement supplies, as people had additional money and time at home.

How Did Ocean Carriers Respond?

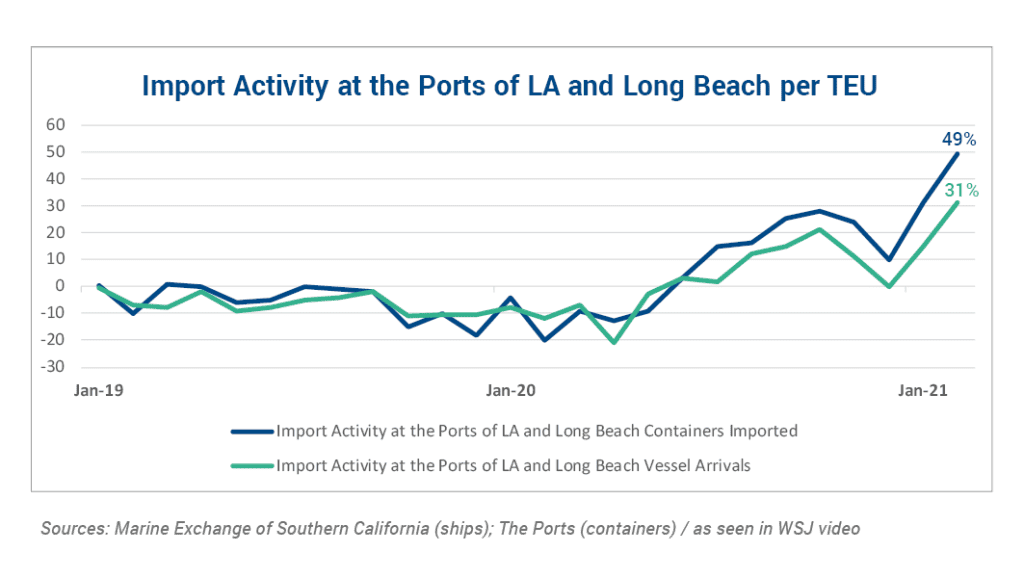

Another contributing factor has come to light throughout the year – the vessels themselves are now larger and carry more containers. These larger ships are more challenging to position, park, unload and reload, adding to the delays at ports.

For example, 31% more ships arrived in March at the ports in greater Los Angeles, bringing 49% more containers to handle year-over-year. Additional equipment and time are needed to address the gap in volume, leading to further delays in berthing waiting vessels. Coupled with the skilled dockworker shortage in Q1, this created an unprecedented backup of ships moored in San Pedro Bay waiting to arrive in port.

Time is Money

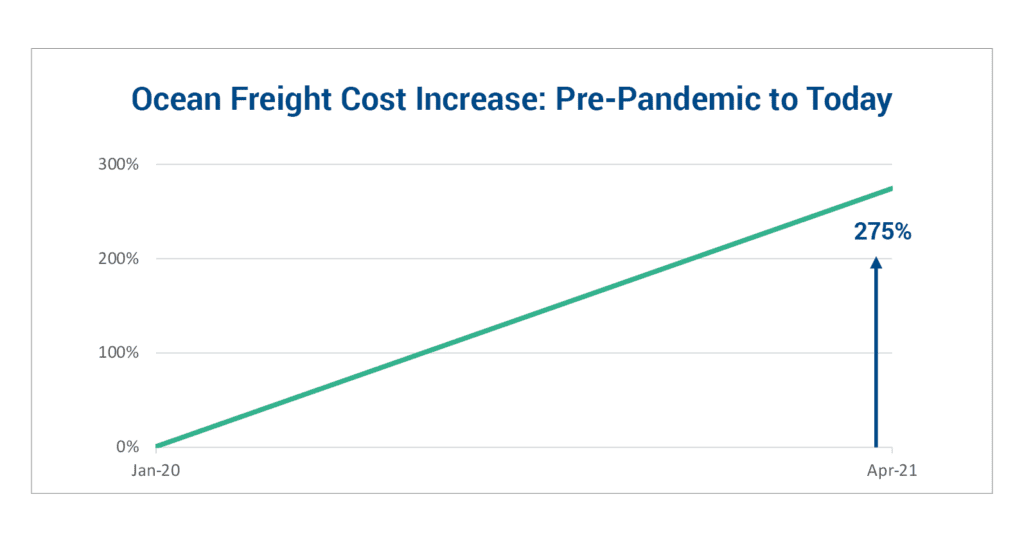

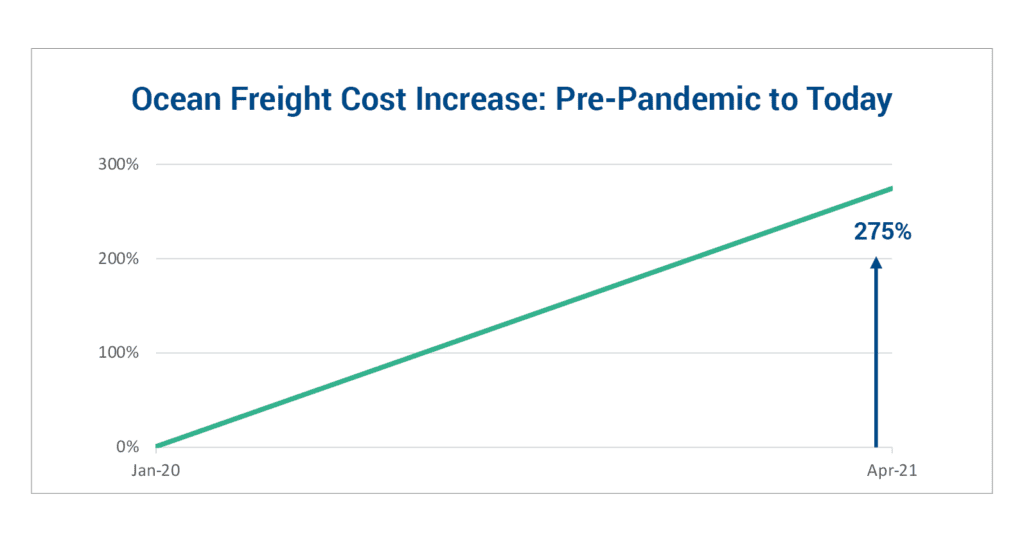

Shipping costs continue to increase across all international modes, as space is limited and delays are lengthy. With the volatile ocean market and supply chain delays and the limited capacity and spillover need to the airfreight market, shippers cannot continue to bear the burden of these unprecedented transportation expenses. Currently, costs for ocean freight are upwards of 275% higher than what shippers paid in January 2020. Airfreight costs have been even more volatile, with prices, at times, going to the highest bidder. Consumers are not only forced to wait on delayed goods; they have also seen the cost of their purchases rise to accommodate freight costs.

How Can Shippers Protect Themselves to Ensure Coverage and Secure the Best Pricing In the Market Today?

Ascent recommends educating yourself on the current market. For more information on the topics discussed, this video from the Wall Street Journal is a great resource.

We also recommend shippers develop a relationship with an international brokerage or 3PL, who can help shippers navigate limited capacity and skyrocketing rates By doing this, shippers gain access to a large pool of relationships their broker has with providers and experienced team members to assist with innovative solutions to circumvent issues in the supply chain as they arise.

Ascent Global Logistics offers this and more. Our depth and expertise across all modes afford clients creative shipping solutions, all while watching your bottom line. Ascent helps its clients simplify supply chain management by providing customized solutions, premium customer service and state-of-the-art technology.