Compliance Made Clear: OBC Regulations for Mexico Imports

07/18/2024

On-Board Courier (OBC) services play a crucial role in global trade, involving hand-carrying high-value or time-sensitive shipments on commercial flights for secure and efficient delivery with minimized handling risks.

While OBC is well-established in regions like the U.S., Europe and Asia, Mexico is developing its regulatory framework and enforcement for these services. It’s essential to understand these evolving requirements to navigate customs processes smoothly and protect your cargo from any risks. Shipping goods to Mexico requires staying on top of regulations to ensure your shipments follow all necessary guidelines, especially when using OBC services for reliable and timely transportation.

Tackling Import Challenges in Mexico

The Mexican Tax Administration Service (SAT) recently flagged irregular practices in imports via courier and parcel services, including:

- – Under-Valuation of Goods: Declaring lower values to reduce taxes, risking significant fines.

- – Order Manipulation: Changing order details to avoid regulations, affecting credibility and efficiency.

- – Delays and Penalties: Non-compliance leading to customs delays and penalties, disrupting supply chains.

If utilizing OBC services for shipping to Mexico, it’s important to recognize these risks and take proactive steps to address them. Confirming accurate valuation of goods, keeping order details clear and consistent and partnering with trusted logistics providers can help avoid compliance issues. Regular audits and compliance checks are also essential to prevent delays and penalties, maintaining the integrity of supply chains and protecting business operations from financial and reputational harm.

For example, an electronics manufacturer needing urgent delivery of critical components to a factory in Mexico can rely on OBC services for time-critical transportation. Without proper oversight, these components could be undervalued to reduce taxes, or order details could be manipulated to bypass customs regulations, leading to significant fines and disruptions.

OBC to and from Mexico: Ensuring Compliance with Essential Documentation

Importing into Mexico

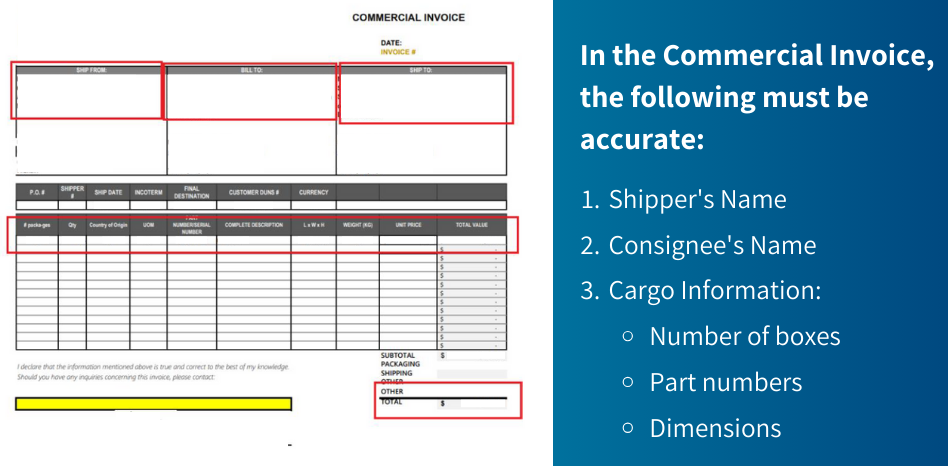

For a smooth OBC shipping experience to Mexico, it is crucial to have the correct documentation, particularly the commercial invoice. This document is indispensable for hand carry services and must be thoroughly reviewed upon receipt from the customer to confirm the accuracy of the provided information.

Key details to verify on the commercial invoice include:

- – Shipper’s Name

- – Consignee’s Name

- – Cargo Information, including number of boxes, part numbers and dimensions

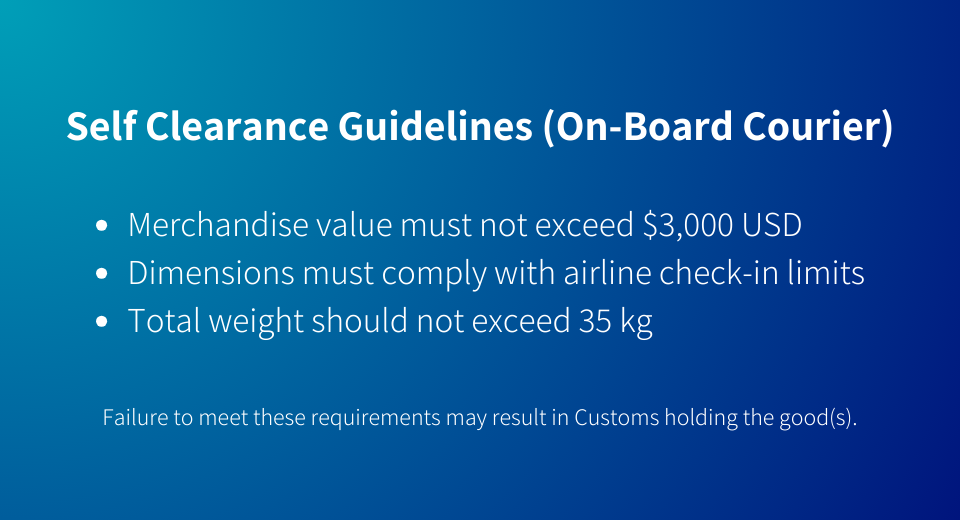

When using OBC services to import into Mexico, it’s essential to follow self-clearance guidelines. For your merchandise to qualify, the value must not exceed $3,000 USD, the dimensions must comply with airline check-in limits and the total weight should not exceed 35 kg. If the value exceeds $3,000, a customs broker is required.

However, each airport may have its own specific requirements and restrictions that change frequently. This highlights the importance of partnering with a trusted shipping provider who understands local airports, maintains contacts in these regions and stays updated on regulatory changes. By leveraging the expertise of a reliable logistics provider, you can streamline your import process to prevent potential delays and focus on your core business operations.

Exporting from Mexico

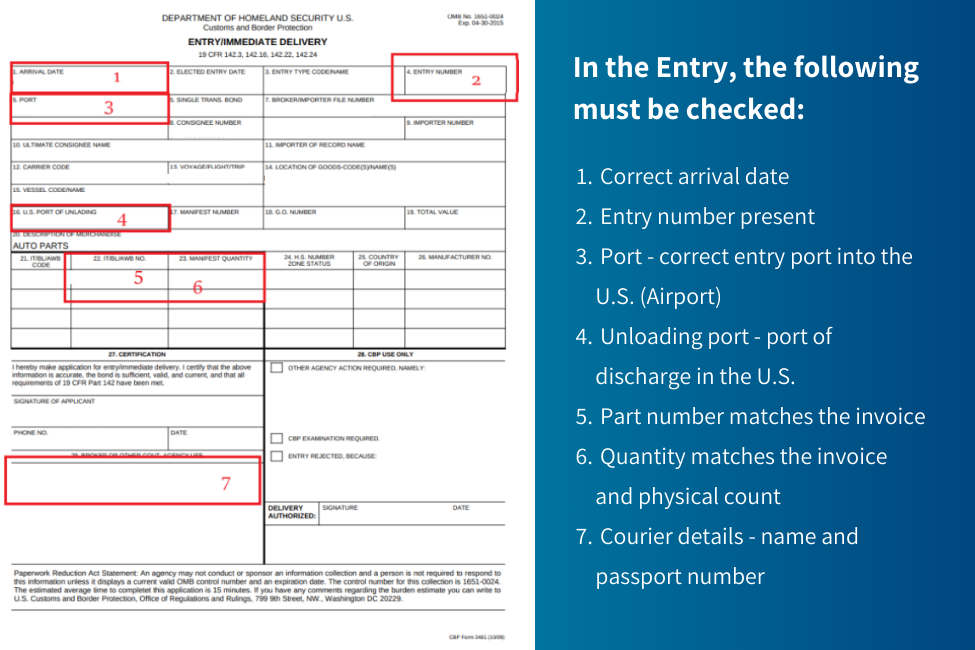

Ensuring a seamless OBC shipping experience from Mexico to various destinations involves a rigorous review process to verify the accuracy of invoices and customs entries managed by local brokers. This process ensures alignment across all aspects, including cargo, invoice details and customs documentation.

Different countries may have varying regulations and required documentation. For instance, when shipping to the U.S., a critical document is the Entry document issued by customs brokers upon cargo clearance. This document is essential for confirming compliance with U.S. Customs regulations and includes critical information such as:

- – Arrival date

- – Entry number

- – Correct port identification

- – Part numbers and quantities matching the invoice and physical cargo

The Entry must also contain accurate courier information for proper documentation. Carriers and couriers meticulously verify all invoice details, customs entries and cargo information to maintain accuracy and compliance with regulations.

Choosing a Logistics Partner for OBC Shipments

Shipping to Mexico comes with challenges due to complex regulations and the need to avoid corruption. It’s essential to understand these rules and follow the correct procedures for a smooth and legal shipping process.

By partnering with a reliable logistics provider like Ascent Global Logistics, who understands the intricacies of the location, airports and key personnel, you can trust that all necessary documentation will be handled correctly. This ensures compliance with OBC regulations and local customs requirements, reducing risks, avoiding delays and providing a seamless shipping experience to Mexico.

Secure and Compliant Shipments with Ascent’s OBC Service

Navigating Mexico’s evolving import rules requires a dependable partner. Ascent’s OBC service provides a reliable solution for the safe and compliant transportation of your goods.

With 40+ years of expertise and a global network of 200+ couriers, our team keeps a close watch on regulatory changes to adhere to all customs regulations. We conduct proactive checks to avoid fines, penalties and charges related to non-compliance such as smuggling or tax evasion to protect shipments from disruptions and financial losses.

Trust Ascent to handle your critical shipments with the highest level of care, ensuring they are transported safely, within regulations and in the best interest of your business. Learn more about Ascent’s On-Board Courier solution today.

Nearshoring in Mexico: What’s Really Driving the Shift?

August 7, 2025

Thank you for contacting Ascent!

A member of our team will be in contact within a few business hours.

Okay